In the realm of multifamily real estate, the year 2023 has brought forth intriguing shifts and developments. As we delve into the latest insights provided by Yardi Matrix surveys across 140 markets, we witness the multifaceted nature of this sector’s performance. From asking rent fluctuations to occupancy rates, this article will dissect the key highlights and trends that have defined the multifamily real estate landscape in the mid-year of 2023.

Asking Rents: A Delicate Balance

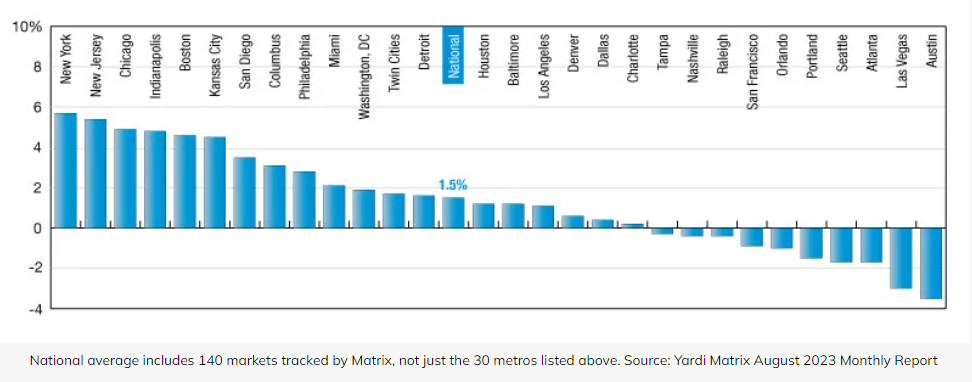

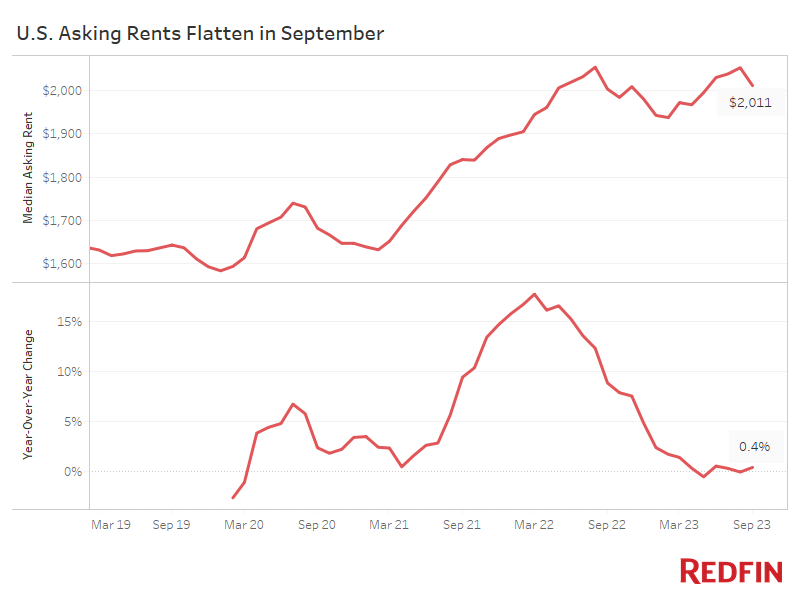

The multifamily real estate industry has been a beacon of stability in the ever-changing economic landscape. In August, the average asking rent in the United States nudged up by $1 to $1,728, reflecting a modest 1.5 percent year-over-year increase. However, it’s crucial to note that this growth represents a 420-basis-point decline since the beginning of the year.

This intriguing dip can be attributed to the supply expansion on a metro level, which has placed downward pressure on rent growth. The multifamily sector, though, remains resilient, with occupancy rates steadfastly holding at 95 percent for the past four months.

Single-Family Rentals: A Deceleration in the High-End Segment

While multifamily rentals have witnessed a nuanced performance, the single-family rental (SFR) segment has its own narrative. In August, single-family rents experienced a 0.5 percent year-over-year increase, reaching $2,104. This upward movement signifies a deceleration in the high-end rental market, as single-family rentals have been an attractive option for many.

A Regional Perspective

Rent growth patterns have been diverse across regions. Sun Belt metros, which were previously performing exceptionally well, have returned to a more average rent performance. In contrast, markets in the Northeast and Midwest have emerged as leaders in rent growth. Low supply expansion and high occupancy rates have been the driving forces behind the growth in these regions.

Consistency and Volatility

Despite fluctuations in rent growth, the national average occupancy rate has remained impressively stable, holding at 95.0 percent for the fourth consecutive month. This figure represents a 0.8 percent year-over-year decline, showcasing the consistency of the multifamily sector in maintaining high occupancy rates.

Overview of the Current Multifamily Debt Market Landscape

Federal Reserve Analysis: The annual Jackson Hole Symposium initiated today, featuring Jerome Powell scheduled to speak on Friday morning. This year’s symposium holds particular significance due to the lingering uncertainty surrounding the future trajectory of monetary policy. With the Federal Reserve’s commitment to being “data-driven,” it remains intriguing to observe how they will respond to decreasing inflation, reduced hiring rates, and apprehensions of a global economic slowdown. Current expectations indicate that the Federal Reserve will adopt a pause stance in their September meeting. As of August 23rd, the likelihood of a rate hike stands at a mere 11.5%. Futures markets reflect an 88.5% probability that the Federal Reserve will maintain the pause in the September meeting, with a 60.9% chance of continued pause in November. Capital market activities will likely remain subdued until concrete evidence emerges confirming the conclusion of the interest rate cycle. Monitoring the probability of a rate hike from the Federal Open Market Committee (FOMC) can be facilitated through the CME Fedwatch Tool.

Banks: Banks have adopted a more conservative approach when assessing potential deals. Extensive stress testing, Federal Audits, and proactive asset management have become the primary focus of their operations. Nevertheless, quotes are available in the 6.00-6.50% range for transactions characterized by steady collections and a robust tenant mix. Banks offer fixed rate programs spanning 3, 5, and 7-year fixed rates with step-down prepayment options. Floating rate alternatives typically carry spreads ranging from 275-350 basis points over the Secured Overnight Financing Rate (SOFR). Lenders across the board have decreased their target LTV ratios by 5% to 10%, emphasizing the significance of deposits and existing relationships to secure more favorable interest rates.

Debt Funds: Pricing in the debt funds sector has recently experienced a widening trend, with most entities capping their loan-to-cost ratios at around 60-70%. These funds place primary emphasis on stabilized debt yield and the existing cash flow or lease-up potential for multifamily or industrial property types. Expect to find spreads ranging between 300-425 basis points over SOFR. Notably, in the multifamily segment, several debt funds actively seek preferred equity positions to complement agency senior loans.

CMBS (Commercial Mortgage-Backed Securities): CMBS transactions are preferably structured with 10-year terms, as pricing becomes more challenging for 7- and 5-year terms. CMBS spreads have witnessed a contraction over recent weeks, resulting in rates spanning from 6.85% to 8.75%. These rates are contingent on factors such as loan size, property quality, property type, and debt yield. Loan terms within the CMBS market typically encompass 5- to 10-year fixed rates, reaching up to 75% LTV and often featuring full-term interest-only (IO) payments.

Agencies: Fannie Mae and Freddie Mac continue to compete vigorously in the mission-driven business segment. Deals with a substantial mission orientation command competitive pricing in the mid-100s basis point range. As of July, Fannie Mae’s business volume reached $31.1 billion, compared to $39.2 billion the previous year. Similarly, Freddie Mac’s new business volume stands at $24.4 billion year-to-date, down from $34.8 billion in the first half of 2022. Overall, Agency pricing hovers around 5.80-6.00%. Rate buydowns are gaining prominence as an effective alternative for borrowers, especially given the current market climate characterized by volatile benchmarks.

A Year of Transformation

As we look back at the multifamily real estate landscape in 2023, it’s clear that this year has brought both challenges and opportunities. The multifamily sector has demonstrated resilience despite the headwinds of supply expansion, while single-family rentals continue to attract tenants seeking high-quality living spaces.

In conclusion, the multifamily real estate industry remains a dynamic and ever-evolving sector. The balance between supply and demand, rent growth patterns, and regional variations make it a fascinating field to watch. As we move forward, adaptability and strategic decision-making will be the keys to success in this evolving landscape.

FAQs

1. Is the multifamily real estate sector a good investment in 2023?

The multifamily real estate sector continues to offer investment opportunities, but investors should carefully analyze specific markets and consider factors like supply and demand dynamics.

2. What is driving the deceleration in high-end single-family rentals?

The deceleration in high-end single-family rentals can be attributed to various factors, including changing tenant preferences and market dynamics.

3. Are there regional variations in multifamily rent growth?

Yes, regional variations in rent growth exist, with markets in the Northeast and Midwest outperforming Sun Belt metros in 2023.

4. How has the employment market impacted the multifamily real estate sector?

A strong employment market has contributed to sustained demand in the multifamily real estate sector in 2023.

5. What should investors consider when entering the multifamily real estate market?

Investors should consider factors such as market research, location, and property management when entering the multifamily real estate market.